The Dangers of Overpricing

The Truth about Home Pricing in the San Francisco Market

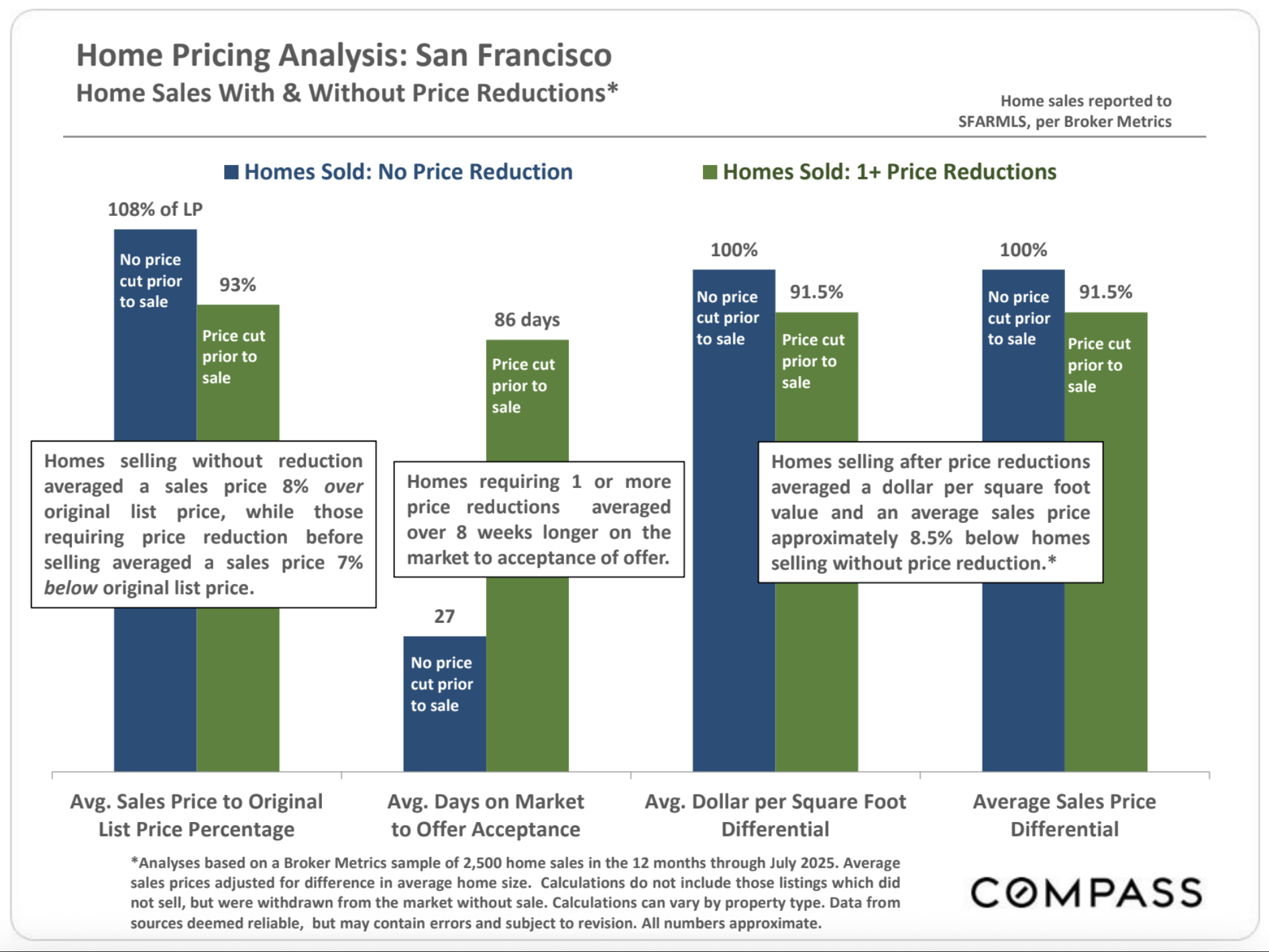

Overpricing one’s home prior to going on market almost always has severely negative ramifications for sellers: Across the country, listings that require price reductions before selling consistently take much longer to sell and sell for significantly lower average values than homes priced correctly. Conversely, overpriced homes can provide opportunities for buyers who carefully track time on market and price reductions. Such buyers will almost always face reduced competition, eliminate the need for overbidding, and allows for more aggressive negotiation of the sales price and terms.

Using data on tens of thousands of home sales occurring over a period of 12 months, we performed analyses such as this one on 5 Bay Area regions comprising 10 counties, comparing house, condo and townhouse listings that sold without reducing list price prior to sale, to those that required one or more price reductions before going into contract and closing sale. The specific results varied by market region, but dramatic differences in sales-price-to-original-list-price percentages, overbidding and underbidding, average days-on-market, speed of sale, and average sales values were universal.

“Ironically, instead of getting more money… [Over-pricing] usually stigmatizes a property and reduces the eventual sale price to less than it would have been with more realistic pricing.”

“…in all the regional analyses we performed comparing the 2 types of sale, the average change in value – i.e. the average loss in value seen in price reduced homes – was about 10%.”

The correct calculation of “fair market value” before going on market typically has large financial consequences: By not doing so, a seller is typically giving a large discount on sales price to the buyer ultimately purchasing their home. Fair market value is that price a qualified, reasonably knowledgeable buyer is willing to pay, which a seller, not under duress, is willing to accept after the home has been properly exposed to the market.

Neither agents nor sellers determine market value: Only the market itself – willing and able buyers – establishes value. A comprehensive comparative market analysis is the best way to estimate current fair market value prior to listing the home for sale. Agent and seller then work together to create a plan – pricing, preparation and marketing – to maximize the conditions that reliably achieve the highest possible sales price. A comparative market analysis (CMA) reviews “comparable” properties that recently sold, active listings on the market, listings pending sale, and listings removed from the market without selling, while factoring in the effects of existing economic and real estate market conditions and trends. Because individual homes are relatively unique commodities – varying in location, architecture, condition, circumstances, systems and amenities – and the market is constantly changing, a comprehensive CMA relies upon a straightforward analysis of data, as well as the experience to weigh the many factors at play, to arrive at an informed estimate of fair market value at a specific point in time. It is one of the most important services qualified agents provide their clients.

The vast majority of buyers will not make offers on homes they consider significantly overpriced. Either they don’t want to waste their time or are uncomfortable with possibly “offending” the seller. They simply move on to other listings they consider fairly priced.

Well-priced or low-priced homes create a sense of urgency in the buyer/broker communities to act quickly with strong, clean offers, and often lead to competitive bidding between buyers – which is the most likely way to increase sales price.

Overpricing wastes the optimum moment of buyer and broker attention: When it first comes on the market. This moment cannot be recaptured.

Overpriced homes kill any sense of buyer urgency and take (much) longer to sell, which then significantly reduces value in buyers’ minds: “There must be something wrong with it if it hasn’t sold by now.” It almost always eliminates the possibility of competitive bidding.

If a listing has inadvertently been overpriced (or market conditions suddenly cool), the sooner it is recognized as such and the price adjusted, the smaller the negative impact. Price reductions must be big enough to regain the attention of buyers and their agents – typically at least 5%.